How Much House Can I Afford? Affordability Calculator

Table Of Content

Your real estate tax bill will change annually, as will the premium on your homeowners insurance policy, for example. Debt-to-income ratio (DTI) is a lender term used to determine home affordability. The ratio is determined by dividing the sum of your monthly debts by your verifiable monthly income. Mortgage insurance is required for conventional loans via Fannie Mae and Freddie Mac when the down payment is less than 20%. This type of mortgage insurance is known as private mortgage insurance (PMI).

What factors help determine 'how much house can I afford?'

Is your credit score in great shape, and is your overall debt load manageable? Do you have enough savings that a down payment won’t drain your bank account to zero? If your personal finances are in excellent condition, a lender will likely be able to give you the best deal possible on your interest rate.

Faster, easier mortgage lending

For one, you will have room to bid if you end up competing with another buyer for the house. As an alternative, you’ll have money for renovations and upgrades. A little work can transform a home into your dream house — without breaking the bank. Even though Martin can technically afford House #2 and Teresa can technically afford House #3, both of them may decide not to. If Martin waits another year to buy, he can use some of his high income to save for a larger down payment.

How lenders decide how much you can afford to borrow

LendingTree’s calculator defaults to a 30-year fixed-rate mortgage, but there’s a 15-year fixed-rate term option if you want to save on interest charges and can afford a higher monthly payment. If you go with this plan it’s important to make sure your mortgage terms don’t include a penalty for paying off the loan early. This is known as a pre-payment penalty and lenders are required to disclose it.

Formula for calculating a mortgage payment

If the property is your principal place of residence, you’re entitled to the homeowner’s exemption of $7,000 decreased assessed value, which cannot surpass $70 in savings. Getting approved for a loan with Rocket Mortgage tells you exactly how much of a loan you can qualify for. Getting preapproved is quick and easy – you can even apply online from the comfort of your home. For instance, if you want a lower monthly payment then you’ll want to choose a 30-year loan term.

Mortgage Affordability Calculator

Some types of mortgages (such as a VA-backed loan) will require additional tests such as termite inspections. Any additional services will cost extra, but may help you discover serious issues prior to moving in, such as a mold infestation. California doesn’t have as high of risk for radon as some regions in the U.S. However, there are some areas, such as Tulare, that are depicted as having high concentrations of radon, according to the California Department of Conservation’s indoor radon potential map. You’ll want to check to see if your property is in one of those high-risk areas. Refinance your existing mortgage to lower your monthly payments, pay off your loan sooner, or access cash for a large purchase.

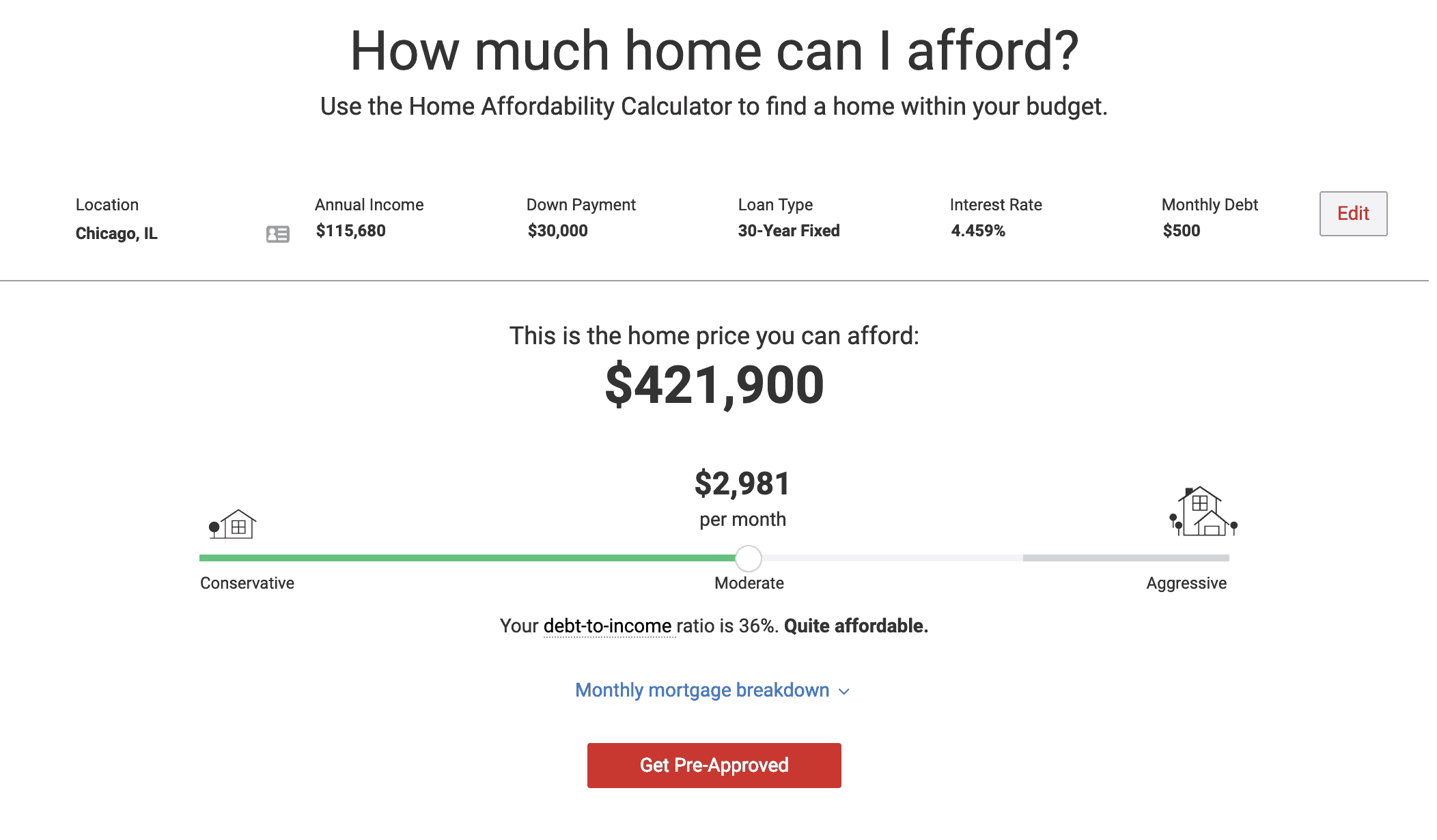

Also, federal regulations require lenders to look at your debt-to-income ratio. You generally can’t get a qualified mortgage that would give you a debt-to-income ratio of more than 43%. In practice, many lenders want your debt-to-income ratio to be no higher than 36%.

How to lower your monthly payments

While it's true that a bigger down payment can make you a more attractive buyer and borrower, you might be able to get into a new home with a lot less than the typical 20 percent down. Some programs make mortgages available with as little as 3 percent or 3.5 percent down, and some VA loans are even available with no money down at all. Loans backed by the FHA can also have more relaxed qualifying standards — something to consider if you have a lower credit score.

Monthly debts

NerdWallet's Mortgage Calculators - NerdWallet

NerdWallet's Mortgage Calculators.

Posted: Tue, 25 Aug 2020 16:56:30 GMT [source]

The San Francisco area remains the nation’s least affordable major housing market. Based on Census Bureau data, the median home value in San Francisco County is $1,152,300. In Santa Clara County, median home values fall a bit to $1,061,900, while Marin County has a median value of $1,053,600.

Key factors in calculating affordability are 1) your monthly income; 2) cash reserves to cover your down payment and closing costs; 3) your monthly expenses; 4) your credit profile. A large portion of your closing costs are paid to the lender and are known as origination fees. This includes underwriting, processing, mortgage broker fee, origination points, document preparation and commitment fees. Additional funding fees or other charges will potentially be added to the total, if you’re getting a VA loan or other specialized type lending option.

Mortgage Calculator - Investopedia

Mortgage Calculator.

Posted: Fri, 05 Feb 2021 18:27:58 GMT [source]

If you are taking out a conventional loan and you put down less than 20%, private mortgage insurance will take up part of your monthly budget. The PMI’s cost will vary based on your lender, how much money you end up putting down, as well as your credit score. It is calculated as a percentage of your total loan amount, and usually ranges between 0.58% and 1.86%.

The Golden State has a non-judicial (no courthouse involvement) process for deeds of trust that include a power-of-sale clause and a judicial process for mortgages. However, the most common foreclosure in the state is non-judicial, which generally means a speedier process. When a lender includes a power-of-sale clause, the lender trades a full loan payout for timeliness.

Comments

Post a Comment